Dates: 9 to 11 July 2025

Duration: 3 days

Level: Beginner

Venue: Singapore University of Social Sciences

Synopsis

This course is designed to provide a comprehensive understanding of the world of angel investing, its benefits and risks, due diligence and valuation techniques, and legal and regulatory considerations. The participants will gain an in-depth understanding of a startup, the entrepreneurial mindset and traits necessary for success, and how to identify promising startups in the ecosystem. In addition, they will learn about the investment process, including negotiating terms, creating investment agreements, and closing deals.

By the end of the course, the participants will be equipped with the knowledge and skills necessary to become a successful angel investor.

The course is a collaborative effort with ACE.SG (Action Community for Entrepreneurship)

Who Should Attend

The course is suitable for anyone who is interested in developing skills and knowledge necessary to become an angel investor in startups.

Topics

- Introduction to Angel Investing

- Understanding Startups and Entrepreneurs

- Due Diligence and Valuation

- Investment Process

- Role of the Angel Investor

- Portfolio Management and Exit Strategies

- Legal and Regulatory Considerations for Angel Investing

Case Studies and Group Discussion: Review and apply concepts learnt, discuss real-world scenarios

Objective

Master the knowledge and skills necessary to become a successful angel investor.

A. Knowledge and Understanding (Theory Component)

By the end of this course, you should be able to:

- Define the concept of angel investing and describe its role in the startup ecosystem.

- Identify the potential benefits and risks associated with investing in startups.

- Understand the entrepreneurial mindset and traits necessary for success in the startup world.

- Recognize the different players and their roles in the startup ecosystem

- Understand the role of an angel investor, including providing mentorship and support.

B. Key Skills (Practical Component)

By the end of this course, you should be able to:

- Develop skills necessary to identify promising startups for investment

- Conduct due diligence process and the importance of valuation techniques

- Negotiate investment terms and create investment agreements with startups

- Develop portfolio management strategies and exit plans for investments

- Navigate the legal and regulatory considerations of angel investing, including securities regulations and tax implications

Schedule

| Time | Agenda |

|---|---|

| Day 1 | |

| 09.00 - 11.00 | Introduction to Angel Investing part 1 |

| 11.00 - 11.15 | Break |

| 11.15 – 13.15 | Introduction to Angel Investing part 2 |

| 13.15 - 14.15 | Lunch Break |

| 14.15 - 15.45 | Understanding Startups and Entrepreneurs part 1 |

| 15:45 - 16:00 | Break |

| 16:00 - 17:30 | Understanding Startups and Entrepreneurs part 2 |

| Day 2 | |

| 09.00 - 10.00 | Role of the Angel Investor |

| 10.00 - 10.15 | Break |

| 10.15 – 12.15 | Due Diligence and Valuation part 1 |

| 12.15 - 13.15 | Lunch Break |

| 13.15 - 14.15 | Due Diligence and Valuation part 2 |

| 14.15 - 15.15 | Investment Process part 1 |

| 15.15 - 15.30 | Break |

| 15.30 - 17.30 | Investment Process part 2 |

| Day 3 | |

| 09.00 - 11.00 | Legal and Regulatory Considerations for Angel Investing |

| 11.00 - 11.15 | Break |

| 11.15 – 12.15 | Portfolio Management and Exit Strategies Part 1 |

| 12.15 - 13.15 | Lunch |

| 13.15 - 14.15 | Portfolio Management and Exit Strategies Part 2 |

| 14.15 - 14.30 | Break |

| 14.30 - 17.30 | Case Studies and Group Discussion: Review and apply concepts learnt, discuss real-world scenarios |

*SUSS reserves the right to change the course dates, topics and trainers.

Assessments

- Group Presentation

Requirements

Participants with basic knowledge of English, statistics, and communication skills

About the Trainer

Huang Shao-Ning

Partner and Chief Angel, AngelCentral

Shao-Ning started her first business JobsCentral as a fresh graduate back in 2000. She grew and exited the business in 2011 to CareerBuilder. She cares about processes and about doing things for the right reasons. Since her exit, her life focus has been to be relevant and pay it forward. Shao-Ning has been actively advising deep tech startups and also some social entrepreneurs. She is a peer-mentor to many women but most importantly she is a wife and mom to four boys. In the family angel/PE portfolio, she (and Der Shing) has investments in over 40 startups (of which, 6 are led by women CEOs!) and 8 VC investments.

Lim Der Shing

Partner, AngelCentral

Der Shing is an experienced Angel Investor and has invested (with Shao Ning) over USD$5m into 40 startups and 8 VC funds. He also serves on multiple startup boards and volunteers with the Singapore government on the topic of education and startups in various capacities. As the Former CEO and cofounder of JobsCentral Group, Der Shing led the company’s growth from a 2-man startup into a highly profitable regional job portal with over 150 staff in 3 countries. In 2011, the business was sold to CareerBuilder.

Phey Teck Moh

Partner, AngelCentral

Phey Teck Moh is the Chairman of Xpanasia Pte Ltd, an investment and advisory company specialising in Telecommunications and Information Technology companies in Asia Pacific. He has mentored several companies including Rainmaker Labs, Metro Residences, Homage, XRVision and raised funds for the companies. He has recently retired as President, Asia President, Motorola Solutions in May 2013. He managed and oversaw the business for voice, data and video communications products and systems for private networks and enterprise mobility solutions to a wide range of markets and customers.

Application Procedures

Please submit the following documents to [email protected]:

- Coloured copy (back and front) of NRIC for Singaporeans and PRs, or "Employment"/"S"

Pass for foreign applicant

-

Application form

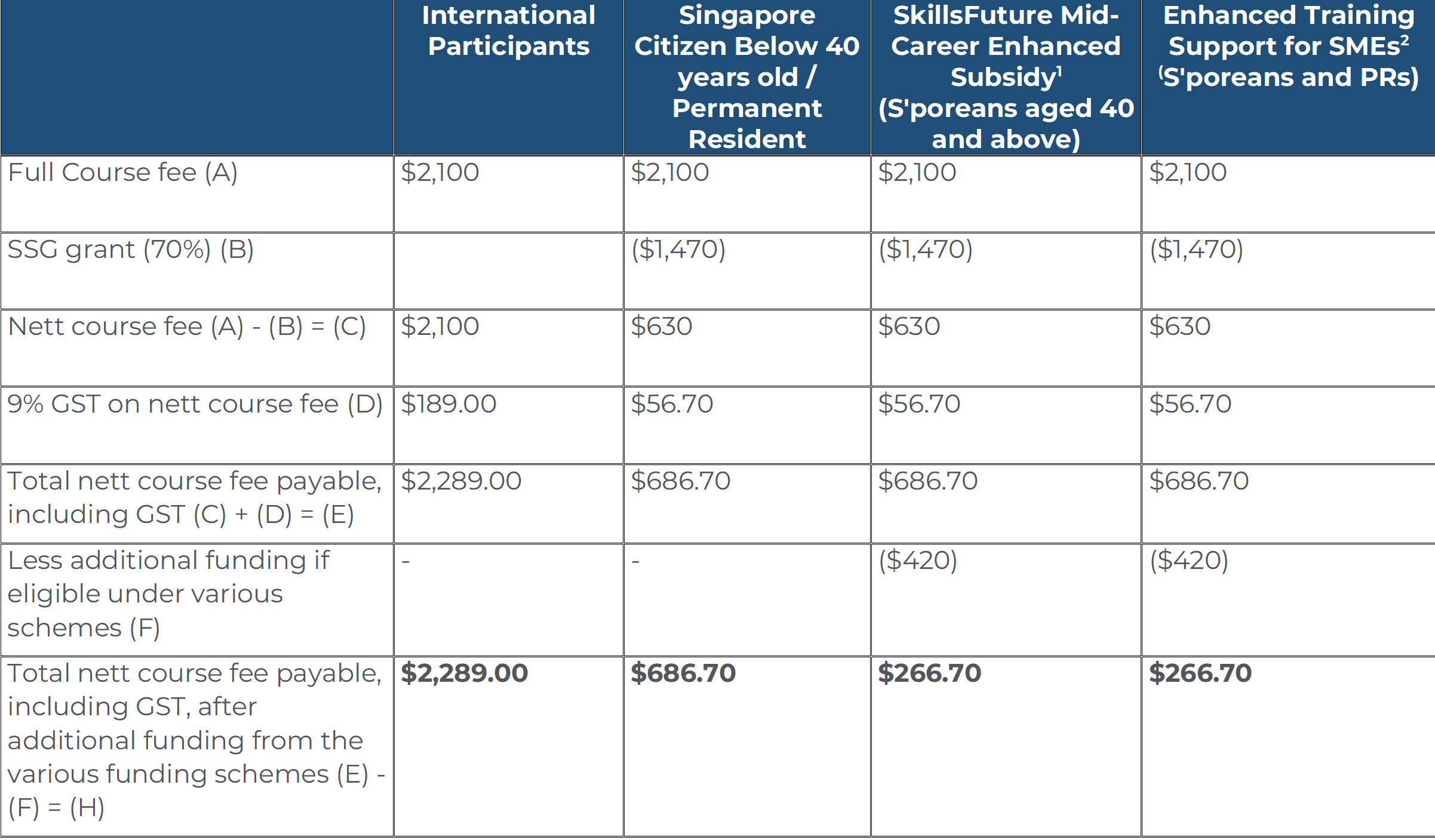

Course Fee

1 Mid-Career Enhanced Subsidy:

Singaporeans aged 40 and above may enjoy subsidies up to 90% of the course

fees.

2 Enhanced Training Support

for SMEs: SME-sponsored employees (Singaporean Citizens and PRs) aged 21

and above may enjoy subsidies up to 90% of the course fees.

Participants are required to achieve at least 75% attendance and pass any prescribed examinations/assessments or submit any course/project work (if any) under the course requirement.

Participants are required to complete all surveys and feedbacks related to the course.

The course fees are reviewed annually and may be revised. The University reserves the right to adjust the course fees without prior notice.

Singapore University of Social Sciences reserves the right to amend and/or revise the above schedule without prior notice.

For clarification, please contact the SUSS Academy via the following:

Telephone: +65 6248 0263Email: [email protected]